Reverse Offer

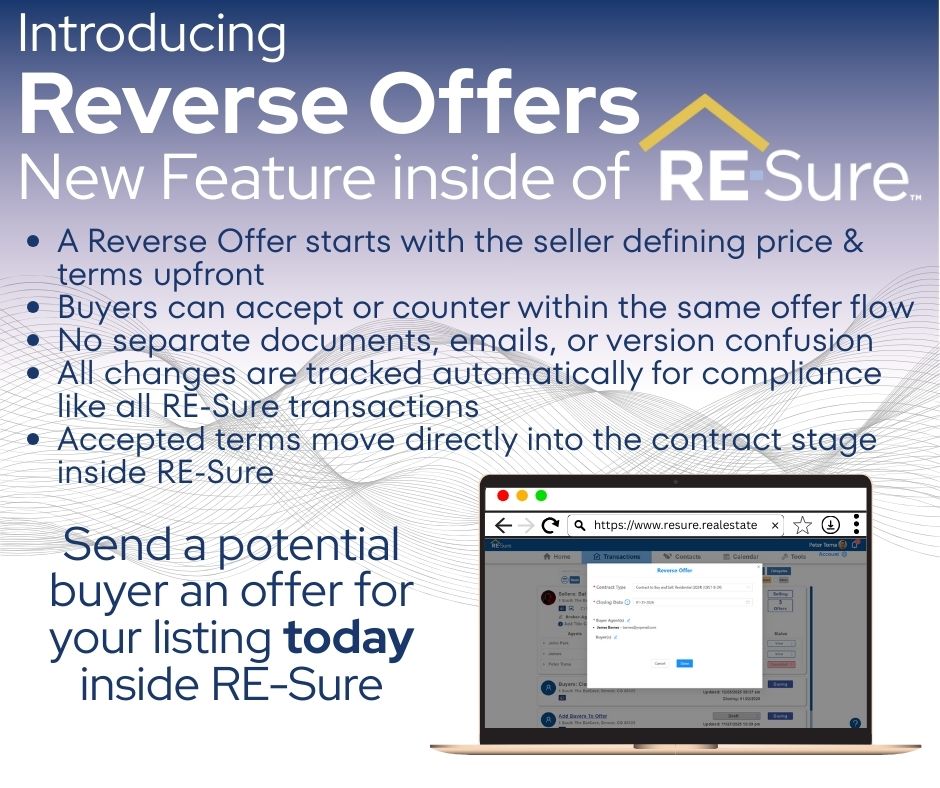

Check Out the New Reverse Offer Capability in RE-Sure

In a buyer’s market, sellers need more than patience, they need creative, proactive tools to move their listings forward. That’s why RE-Sure is excited to introduce a powerful new feature.

You asked. We listened. We built it: Reverse Offers.

What Is a Reverse Offer?

A Reverse Offer allows a seller to initiate an offer directly on their own listing. Instead of waiting for a buyer to submit terms, the seller defines the offer upfront and presents it to a buyer, reversing the traditional offer flow and giving sellers more control over negotiations.

Reverse Offers are especially effective in buyer-driven markets, helping listings stand out, spark engagement, and create momentum.

What Information Is Needed to Create a Reverse Offer?

Creating a Reverse Offer in RE-Sure is simple and streamlined. The seller or listing agent provides:

Buyer information

Buyer agent details

Purchase price and key offer terms

Property address and seller information

RE-Sure automatically populates the appropriate contract fields, reducing manual entry and minimizing errors. Co-brokers can also be added easily by email or manual entry, keeping everyone connected within the transaction.

Built to Keep Transactions Moving

Reverse Offers integrate seamlessly into the RE-Sure transaction workflow with full visibility, document tracking, and security. Sellers gain control, agents gain efficiency, and buyers receive clear, well-structured offers.

Reverse Offers give sellers a smarter way to negotiate and a better way to sell.